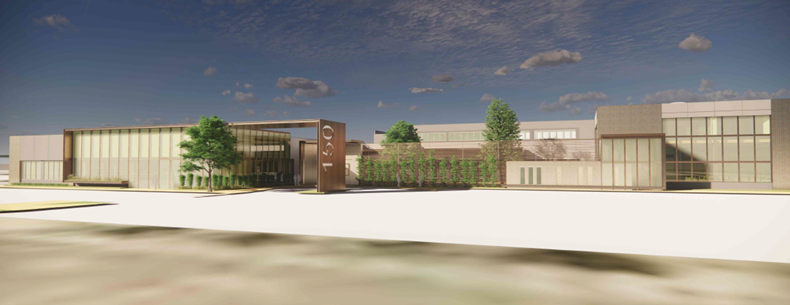

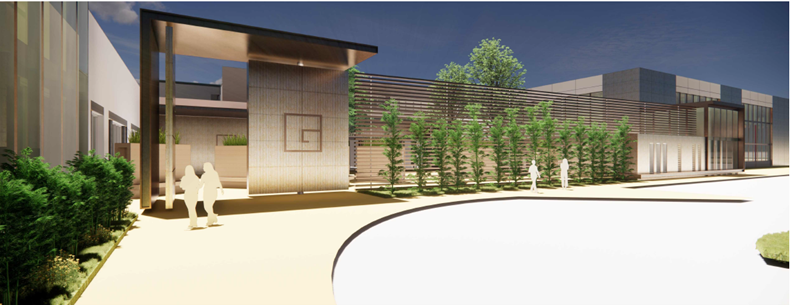

Graymark Capital’s “Gray Matter” Life Science Initiative Recapitalizes 230,000 SF Life Science Building in San Carlos, California

San Francisco, CA, February 2022 – Graymark Capital, Inc. completed a recapitalization of its 230,000 square foot life science project in San Carlos, CA with BentallGreenOak, a global real estate investment advisor.

150 Industrial is an existing life science building that will be re-imagined with new exterior façade, outdoor amenity areas and modern lab buildout. The property has the largest available floor plate on the Peninsula for life sciences and significant infrastructure in power and systems. The project was formerly home to Nektar, Novartis, Mylan Pharmaceuticals and Viatris, producing an inhalant to treat cystic fibrosis in the manufacturing portion of the building.

The Peninsula market is one of the main life sciences clusters in the U.S. Its proximity to Stanford, UCSF and UC-Berkeley life sciences departments provides centers for innovation and a highly-educated workforce. San Carlos in particular is growing its life science community with the leasing of the newly-developed Alexandria Center for Life Science – San Carlos and a number of new life development projects slated for construction.

The project is part of Graymark Capital’s life science initiative, Gray Matter, which focuses on life science conversion projects in the Western United States. “We are excited to provide the market with a modern life sciences project in the heart of the Peninsula” said Principal, Rick Lafranchi.

The investment represents the 6th building purchased in a partnership with BentallGreenOak. The joint venture is focused on medium term leased assets and life science investments in major markets in the western U.S.

BentallGreenOak Managing Director, Matt Cervino, stated, “We are excited to continue to expand BentallGreenOak’s position in the Bay Area life sciences market as well as our strategic partnership with Graymark.”

About Graymark Capital

Graymark Capital, Inc. is a real estate investment firm headquartered in San Francisco, California that invests in commercial property throughout the Western U.S. The company has acquired 3.5 million square feet of institutional quality buildings valued at $1.7 billion since 2012. Founded by Principals Brian Hecktman, Jeff Hoppen and Rick Lafranchi, the company focuses on life science, creative office, R&D and industrial properties with a modern design appealing to the modern tenant. Assets are located in elite infill markets with highly-educated workforces, strong employment growth and attractive quality of life.

For more information, please visit www.graymarkcapital.com

About BentallGreenOak

BentallGreenOak is a leading, global real estate investment management advisor and a globally-recognized provider of real estate services. BentallGreenOak serves the interests of more than 750 institutional clients with approximately $70 billion USD of assets under management (as of September 30, 2021) and expertise in the asset management of office, industrial, multi-residential, retail and hospitality property across the globe. BentallGreenOak has offices in 24 cities across twelve countries with deep, local knowledge, experience, and extensive networks in the regions where we invest in and manage real estate assets on behalf of our clients in primary, secondary and co-investment markets. BentallGreenOak is a part of SLC Management, which is the alternatives asset management business of Sun Life.

The assets under management shown above includes real estate equity and mortgage investments managed by the BentallGreenOak group of companies and their affiliates, and as of 1Q21, includes certain uncalled capital commitments for discretionary capital until they are legally expired and excludes certain uncalled capital commitments where the investor has complete discretion over investment.

For more information, please visit www.bentallgreenoak.com